Consumer Alert: The Consumer Price Index explained. Here’s how the US tracks inflation

[anvplayer video=”5108341″ station=”998131″]

ROCHESTER, N.Y. (WHEC) — We knew it was coming. The Consumer Price Index was released Wednesday which measures how much we paid for goods and services in April.

Consumer prices went up in April 8.3% over April of last year. Compare that to 8.5% in March. This is the first time in months we’ve not seen an increase in annual inflation. But it went up more than the Dow Jones predicted, and the stock market was not pleased.

Let’s go in-depth on exactly what the Consumer Price Index measures. The U.S. Bureau of Labor Statistics price data from 75 cities across the country in eight categories. It’s what the government calls its basket of goods and services.

This is what the bureau calls the basket of goods and services. The categories are as follows:

- Food and drinks -That includes both groceries and restaurant meals

- Housing – primarily your rent

- Clothing – which includes accessories

- Transportation – That includes the cost of vehicles, gas, airline tickets etc.

- Medical care

- Recreation – things like TVs and sports equipment.

- Education and communication – like college tuition and phone services.

- Other goods and services – That’s a broad category that includes everything from haircuts to cigarettes.

Add all that up, and the bureau calculates we’re paying 8.3 percent more this year than this time last year. Economists say the reasons are both simple and complex. It’s the simple principle of supply and demand. In most sectors, we have more demand than supply, but it’s complex in that there are so many global inflationary pressures leading to shortages of everything from gas to wheat.

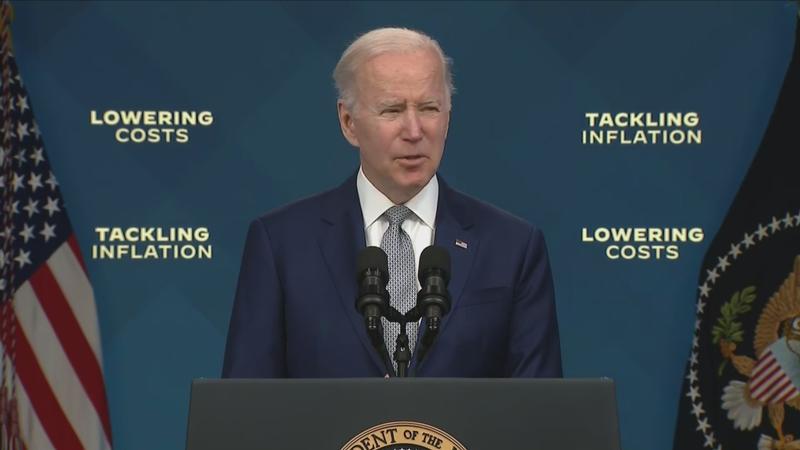

Could there be other factors at play? President Biden appeared to be asking that question when during his Tuesday press conference about inflation. He asked, “The fact is, the average cost of a barrel of oil has been steady for weeks. So why do gas prices keep going up so high?”

[File video, News10NBC]

I posed that question to Patrick De Haan, a petroleum expert with GasBuddy.

“It hasn’t been steady for weeks,” he replied. “It’s been moving violently on a daily basis—up significantly, down significantly, back up significantly. On Monday, oil fell $6.50 per barrel, and then on Tuesday, it went down another $2. And here we are today. At one point oil was up $7 today.”

And he says the oil market is volatile because it’s reacting to the headlines—from Ukraine to the COVID shutdown in China. According to GasBuddy, the average price in Rochester on Wednesday is $4.57. Here’s the good news, if there is any. De Haan doesn’t think we’ll see $5.00 gas any time soon. The cheapest gas I could find in the area on Wednesday afternoon was at Costco, Quicklees in Penfield and Sunoco on North Street in Caledonia.

With the help of Consumer Reports, Here’s Deanna’s Do List for saving at the pump:

- Stay at half. That gives you the flexibility to stop when you see the cheapest gas, not when you absolutely have to get it.

- Combine trips. I always fill up my tank after church because it’s closer to Costco than my house.

- Drive evenly. Consumer reports tests found that hard breaking and acceleration can reduce your gas economy by up to 3 mpg.

- Buy Top Tier gas. The detergents in it are easier on your engine and increase fuel economy.

- Skip premium. Unless your car says premium is required, you get little benefit from premium gas. You can find your car’s octane requirements on the fuel filler door.

- Check your tire pressure. Your tires lose about 1 psi per month. If your tire pressure is too low, your fuel efficiency will be affected.

- Use a gas app to find the cheapest gas near you.

Here are my favorite gas apps: