Local financial expert, college students on student loan moratorium

[anvplayer video=”5079686″ station=”998131″]

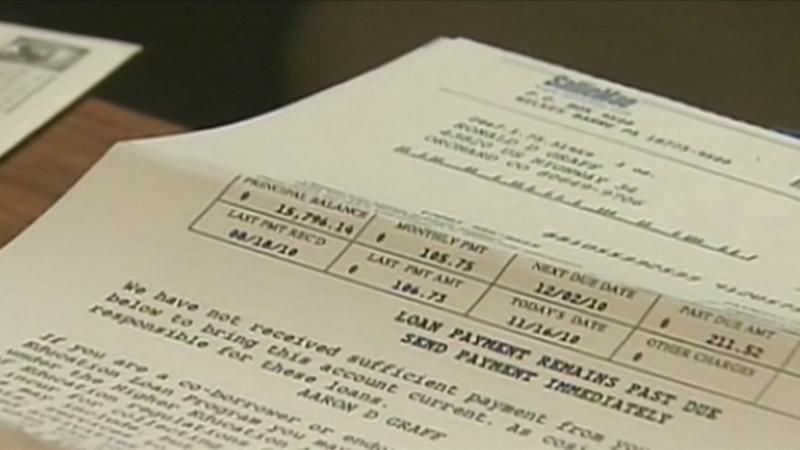

ROCHESTER, N.Y. (WHEC) — The Biden Administration extended the student loan moratorium for federal student debt loans until the first of May. It affects millions of college students, some of whom owe tens of thousands of dollars.

The original student debt moratorium was set to expire at the end of January.

News10NBC heard from some current students and a financial expert who has some important advice to share.

When it comes to federal student loans, President Joe Biden said financial recovery from the pandemic will take longer than job recovery. He had these students in mind who are buried in debt.

Local students like Taylor Wheatly, who attends Monroe Community College are happy to hear the news about the May 1 moratorium.

[News10NBC]

"I feel like postponing those loans is a good decision, because a lot of students are unemployed, and still trying to navigate you know their financial situation. So I think that loans should be the least of our concerns right now," Wheatley said.

During the moratorium interest rates will remain at zero percent, and debt collection efforts are also still suspended. College students will see some extra cash in their pockets.

"It’s Christmas time, it’s the holiday season so there’s a sense of normalcy that you want to be able to buy gifts for your family," Wheatley said.

"Josiah" attends Nazareth College. He said he wishes President Biden would stick more to his campaign promise of wiping out up to $10,000 worth of federal student debt for all borrowers.

"It’s kind of pushing it off which I mean is cool, but if we’re going to base our campaign off of a really big part of it being canceled student debt loan then let’s try to cancel it instead of moving it back five months," he said.

Brighton Securities Chairman George Conboy said the moratorium, or pause is not loan forgiveness. This will eventually end. he shared this piece of financial advice on what to do with those extra dollars.

"Put into a savings, or other kinds of accumulation account where you can have that money available either to pay that down or pay down some other debt," Conboy said. "That way you’re paying yourself first and you’ll be better off."

Conboy said taxpayers will be on the hook for the zero percent interest that’s being forgiven. We’ll see it either in higher taxes, or higher deficit.