News10NBC investigation prompts NYS investigation into nursing home debt collection

[anvplayer video=”5026941″ station=”998131″]

ROCHESTER, N.Y. (WHEC) — Just before the COVID pandemic hit, News10NBC did a series of stories on law firms and nursing homes suing friends, relatives and neighbors of nursing home residents for nursing home debts.

The family and friends were sued because they signed the resident’s admission agreement.

Tuesday, News10NBC confirmed the New York State Department of Financial Services (DFS) is investigating whether that debt collection practice is illegal.

My investigation started with the story of Barbara Robinson.

Two years ago, she was sued for $21,000 in outstanding debt for the care her friend and neighbor received at Monroe Community Hospital, the county-owned nursing home.

[News10NBC]

The story said Robinson was sued because she signed her friend’s admission agreement.

"At first I thought it was a joke," Robinson said during an interview in January 2020.

"It must have scared you though," I replied.

"Well it did when I realized they were serious," she said.

My investigation found more than six dozen lawsuits by non-profit nursing homes against residents, some of them dead, and their daughters, sons, spouses, nieces, nephews and friends.

A search of case files online showed the law firm behind most of the lawsuits is Underberg and Kessler in Rochester, but the Rochester firm of Pullano and Farrow filed a handful too.

In January, the New York DFS issued a subpoena against Pullano and Farrow seeking four years of cases involving nursing home debt collection against third parties. Court documents say the NYS DFS issued the "same subpoena" to "multiple companies that assist skilled nursing facilities with their collection efforts."

On March 8, Pullano and Farrow sued DFS to quash the subpoena and said the firm’s "actions were lawful" based on the previous court "decisions, orders and judgments."

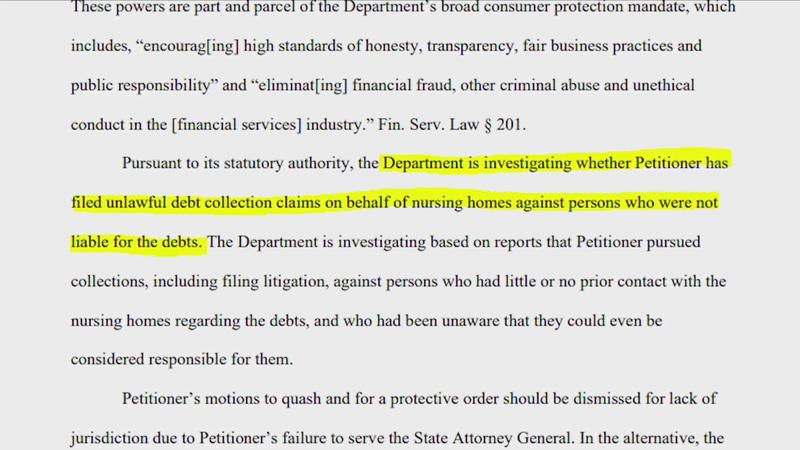

In response, NYS DFS wrote it is investigating whether Pullano and Farrow and other companies, "filed unlawful debt collection claims on behalf of nursing homes against persons who were not liable for the debts." DFS went on to say it’s investigating collections "against who had little or no prior contact with the nursing home regarding the debts, and who had been unaware that they could even be considered responsible for them."

In court documents, DFS wrote the "reported fact pattern… would likely be actionable under the (Fair Debt Collection Practices Act.)"

One of the exhibits filed by the state is my original story on Barbara Robinson.

I contacted the firm of Pullano and Farrow and asked for a statement. The firm shared the following:

We are proud to be the law firm of choice for numerous skilled nursing facilities throughout New York State. We certainly stand by all of the legal services that we provide to our skilled nursing facility clients on a daily basis, which include lawfully collecting the debts owed to facilities when there is a breach of contract. There have been numerous occasions where the highest trial court in this State has reviewed the cases Pullano & Farrow filed on behalf of the skilled nursing facilities the law firm represents, and the court has determined that residents and non-residents can be liable for the debt owed to a skilled nursing facility. Notably, the Department of Financial Services has not identified to Pullano & Farrow nor to the Court any specific cases where the law firm has acted unlawfully, and the courts have never determined that any of the complaints filed by Pullano & Farrow on behalf of its clients were frivolous in nature.

I contacted Underberg and Kessler to see if they received a subpoena. The firm did not reply to my phone call or emails.

In October, the debt claim against Barbara Robinson was dismissed. She no longer owes $21,000.